“Maximizing Growth: Non-Dilutive Capital Advances for Startups”

Introduction: The Challenge of Funding in B2B SaaS

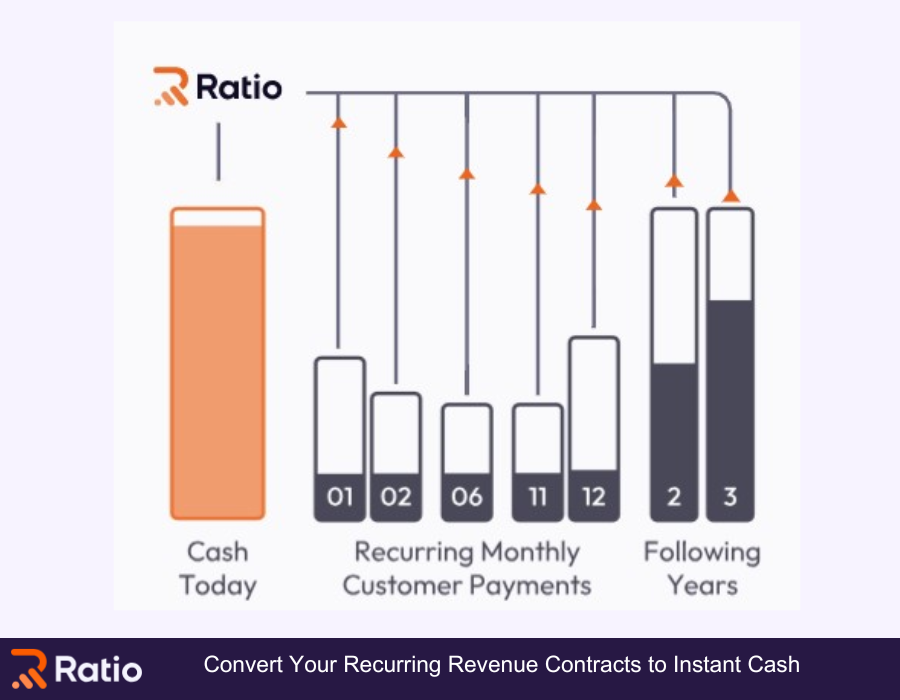

In the competitive world of B2B Software as a Service (SaaS), securing funding without sacrificing equity remains a significant challenge. Startups are increasingly turning to non-dilutive funding methods, such as revenue-based financing and SaaS-specific venture debt, as sustainable alternatives to traditional equity financing. These innovative funding models offer upfront capital that aligns with the SaaS business model, focusing on future revenue generation rather than immediate equity exchange.

Navigating the financial landscape for growth is particularly crucial for startups in the B2B SaaS sector, where rapid expansion and technological advancements are the norms. Non-dilutive capital advances emerge as key players in this scenario, offering a lifeline to startups aiming to maximize their growth potential without the burden of equity loss. This strategic approach to funding not only preserves ownership but also aligns with the dynamic needs of SaaS businesses. As we delve deeper into the world of SaaS financing, understanding how to choose the right non-dilutive options becomes essential for leveraging their full potential in driving sustainable business growth.

Choosing the Right Option for SaaS Growth Financing

Identifying the most suitable non-dilutive funding option is a crucial decision for SaaS companies. This process involves a comprehensive evaluation of the company’s growth plans and capital needs. The ideal funding solution should align with the company's recurring revenue model and growth trajectory while preserving its equity. Non-dilutive financing offers a balanced approach, enabling SaaS startups to scale operations without diluting their ownership.

Exploring non-dilutive financing options for SaaS startups reveals a diverse array of choices, each with its unique pros and cons:

-

Revenue-Based Financing: Tied to the company's revenues, offering flexibility during revenue fluctuations. Pros: Aligns with company performance, minimal equity dilution. Cons: Requires consistent revenue streams.

-

Venture Debt: Tailored for startups with high growth potential. Pros: Access to significant capital, less equity dilution than equity funding. Cons: Can come with covenants and requires repayment.

-

Grants and Tax Credits: Government or private grants and tax incentives. Pros: Non-repayable, supports specific projects or R&D. Cons: Often competitive and may have stringent eligibility criteria.

-

Crowdfunding: Raising small amounts from many backers. Pros: Builds community, no equity loss. Cons: Time-consuming and success isn’t guaranteed.

-

Invoice Financing: Advances based on unpaid invoices. Pros: Quick access to cash, no need to wait for payment terms. Cons: Not suitable for businesses without a solid base of invoicing.

Success Stories in SaaS Financing

Examples from the SaaS sector demonstrate the effectiveness of non-dilutive funding. Companies like WireWheel and Carevive have utilized these methods to expand their customer base and enhance product offerings. Their experiences highlight how strategic financing choices can drive significant growth without relinquishing control or equity.

The success of WireWheel and Carevive in leveraging non-dilutive funding highlights the potential of such methods in maximizing growth. WireWheel, specializing in privacy technology, used its $20 million in non-dilutive financing to not only expand its customer base but also to enhance its product offerings, thereby increasing its market competitiveness. Similarly, Carevive's $19 million investment was pivotal in broadening the scope of its cancer care platform, leading to improved patient outcomes. These examples showcase how non-dilutive funding can be strategically used to fuel significant growth and development in SaaS companies, allowing them to scale operations and innovate without compromising on equity.

Advantages of Non-Dilutive Funding in SaaS

Non-dilutive funding offers several benefits for B2B SaaS startups. It provides the much-needed capital for growth while allowing founders to retain complete control over their company’s direction. This form of funding is particularly well-suited for SaaS companies, as it can be tailored to accommodate the unique cash flow and business models inherent in the SaaS industry.

Sustaining Growth Without Equity Loss

One of the fundamental goals for SaaS companies is to sustain growth without losing equity. Non-dilutive funding emerges as a viable solution, providing the necessary resources for innovation and market competition, all while keeping ownership intact. This approach is especially important for founders who wish to maintain decision-making autonomy and long-term control over their business.

Emerging Trends in SaaS Financing

The landscape of financial options for B2B SaaS companies is rapidly evolving. There is a discernible shift towards more founder-friendly, sustainable financing options like revenue-based financing and SaaS-specific venture debt. These models offer more flexibility and are more attuned to the needs of fast-growing SaaS businesses, marking a departure from traditional, equity-heavy funding methods.

Conclusion: Embracing Strategic Financing for Long-Term Success

For B2B SaaS companies, navigating the path to saas growth financing requires strategic decision-making. Non-dilutive funding stands out as an optimal choice for those looking to scale while preserving equity and autonomy. As the SaaS market continues to expand, the role of these innovative financing options becomes increasingly vital, shaping the future of SaaS companies and supporting their long-term success.

Introduction: The Challenge of Funding in B2B SaaS In the competitive world of B2B Software as a Service (SaaS), securing funding without sacrificing equity remains a significant challenge. Startups are increasingly turning to non-dilutive funding methods, such as revenue-based financing and SaaS-specific venture debt, as sustainable alternatives to traditional equity financing. These innovative funding models…

Recent Posts

- A Healthy Smile for Every Stage of Life: Boca Dental and Braces’ Family-Focused Dentistry in Las Vegas

- Lawn Care Spring Branch Advocates for Property Care: Combatting Weed Growth and Preserving Curb Appeal

- Clearing the Dust: Duct Cleaning Louisville KY Shares Tips to Make Your Home Less Dusty

- Expert Cleaners Lexington Announces Commitment to Safe, Sustainable Cleaning Practices, Expanding to Georgetown, KY

- Expert Cleaners Lexington Announces Commitment to Safe, Sustainable Cleaning Practices, Expanding to Georgetown, KY